JobKeeper 2.0 - The Next Steps

The first tranche of JobKeeper ended on 27 September 2020. We look at the issues for those seeking to qualify for the second tranche of JobKeeper and for those no longer eligible.

Wrapping up JobKeeper

If your business is no longer eligible for JobKeeper payments, there are a few things you need to do:

Advise your employees and business participant. For anyone receiving JobKeeper payments from your business, you should advise them in writing that the business is no longer eligible, JobKeeper payments ceased on 27 September 2020, and their pay will revert to the conditions that apply under their employment agreement. This is particularly important for those who have been receiving top-up payments.

Ensure payroll adjusts – Double check your payroll to ensure that top-up JobKeeper payments have been removed from 28 September 2020 onwards.

Make sure you keep all of your records relating to JobKeeper including your calculations and rationale for the decline in turnover test, your employee JobKeeper nomination forms, and any other records for at least five years.

What’s the 10% decline in turnover test?

The 10% decline in turnover test is a test that enables employers previously participating in JobKeeper to continue to use the JobKeeper provisions (with some modifications) under the Fair Work Act. These employers are ‘legacy employers’. This test does not impact on your business’s eligibility to receive JobKeeper payments, it only impacts on an employer’s use of the JobKeeper provisions under the Fair Work Act.

If an employer qualifies under the 10% test, they can:

Issue JobKeeper enabling stand down directions (with some changes)

Issue JobKeeper enabling directions in relation to employees’ duties and locations of work

Make agreements with employees to work on different days or at different times (with some changes).

Employers can continue to utilise the JobKeeper provisions if they:

Previously participated in the JobKeeper scheme but no longer qualify (or choose not to participate) from 28 September 2020, and

Can demonstrate at least a 10% decline in turnover for a relevant quarter and get a certificate from an eligible financial service provider (small business employers can make a statutory declaration).

To meet the turnover test, a legacy employer needs to demonstrate at least a 10% decline in actual GST turnover for the quarter in 2020, when compared to the same quarter in 2019. See Legacy employers on the Fair Work Ombudsman’s website.

Is my business eligible for JobKeeper payments from 28 September?

Existing JobKeeper participants need to pass the extended decline in turnover test to continue to receive JobKeeper payments on behalf of employees. This extended test looks at your actual GST turnover for the September 2020 quarter (for JobKeeper payments between 28 September to 3 January 2021), and again for the December 2020 quarter (for payments between 4 January 2021 to 28 March 2021).

To pass the extended decline in turnover test, your business will need to show an actual decline in turnover between the September 2020 quarter (July, August, September 2020), and the same period in 2019 by 30% (15% for ACNC registered charities and 50% for large businesses).

My business has not received JobKeeper previously. Can we get it now?

If your business passes the eligibility criteria, you can access JobKeeper when you need it for your eligible employees. For JobKeeper, your business needs to pass the eligibility tests for the period you are seeking to claim JobKeeper payments.

My business can’t pass the decline in turnover test because we were impacted by a natural disaster/drought in 2019

Special rules exist to ensure that businesses trading (or partially trading) in a region impacted by natural disasters or drought in 2019 are not detrimentally impacted when calculating the decline in turnover tests. Assuming the drought or disaster impacted your GST turnover, the alternative test enables you to use a period in the year immediately preceding the year in which the drought or natural disaster was declared for the decline in turnover test comparison. This is, if your business was impacted by drought/disaster in the September quarter of 2019, you can use the September quarter of 2018 for your comparison period. If 2018 was also a drought/disaster zone, you can keep going back until the first year preceding the declaration of drought/disaster.

To use this test, your region must be subject to a formal declaration of drought or disaster (for example from Government) or have been publicly identified by an agency such as the Bureau of Meteorology.

My business fails the test because its turnover is ‘lumpy’

If your business has ‘lumpy’ or irregular turnover, there is an alternative decline in turnover test that you might be able to apply. This test only applies if your GST turnover is irregular, like what often occurs in the building and construction industry, and not simply a seasonal variation. To understand if your turnover is irregular, look at the 12 months before the test period and divide the 12 months into 3 month periods. If the lowest GST turnover for any of these 3 month periods is no more than 50% of the highest of the 3 month periods, then the test can be applied as long as your business’s turnover is not cyclical. Alternatively, you can look at the 12 months before 1 March 2020 instead of the 12 months immediately before the test period.

If your GST turnover is irregular you can compare your current GST turnover for the test period with the average current GST turnover for the 12 months immediately before the applicable test period or 1 March 2020, multiplied by 3.

My business is a new business without a 2019 comparison period. Can it receive JobKeeper payments?

If the business is a new business that started trading after 1 March 2020, the business will not be eligible for JobKeeper payments (although there are special rules for not-for-profit or registered charities in some circumstances).

If your business started trading before 1 March 2020 but after 1 July 2020, there are alternative tests you can use to determine whether your business is eligible for JobKeeper payments from 28 September 2020:

Comparing the actual GST turnover for the test period with the turnover of the 3 months immediately before 1 March 2020 (for example, comparing the September quarter 2020 with the 3 months prior to 1 March 2020).

Comparing actual GST turnover for the test period (for example, the September quarter 2020) with the average turnover since the entity commenced (using whole months).

What happens if a business restructure (or sale or acquisition) impacts on your numbers?

An alternative decline in turnover test is available where there has been a disposal or acquisition of part of the business, or restructure in the business, or combinations of those, and this changed the entity’s current GST turnover.

The alternative test compares the GST turnover for the test period with the current GST turnover for the relevant month immediately after the disposal, acquisition or restructure, multiplied by 3. If there is not a whole month after the last acquisition, disposal or restructure, and before the turnover test period, then the month immediately before the turnover test period is used.

Where there have been multiple disposals, acquisitions or restructures, you can use the whole month immediately after any of the disposals, acquisitions or restructures, multiplied by 3 for the alternative test.

What happens if fast pre COVID-19 growth makes the comparison period unrealistic?

If your business was experiencing strong growth before the pandemic hit, your comparison period numbers can be skewed. This alternative test is for entities with substantial pre COVID-19 growth. First you need to test if your growth is considered substantial. That is, GST turnover increased by:

by 50% or more in the 12 months before the turnover test period or before 1 March 2020, or

by 25% or more in the 6 months before the turnover test period or before 1 March 2020, or

by 12.5% or more in the 3 months before the turnover test period or before 1 March 2020.

If there is substantial growth and you used the period immediately before the turnover test period to determine whether there is a substantial increase in turnover, then the alternative test compares GST turnover for the test period (for example, the September 2020 quarter) with turnover for the 3 months immediately before the test period.

If you are using the period immediately before 1 March 2020 to determine whether there is a substantial increase in turnover, then the alternative test compares GST turnover for the test period (for example, the September 2020 quarter) with turnover for the 3 months immediately before 1 March 2020.

I am a sole trader (or partnership) impacted by illness, injury or leave

For sole traders and small partnerships (4 partners or fewer) with no staff, your income is often impacted by your ability to work. If your comparison period is impacted by illness, injury or leave, you can use the month immediately before the month with sickness, injury or leave is used, then multiplied by 3.

Does the business need to re-enrol?

Your business does not need to re-enrol if it is already receiving JobKeeper payments. Employers continuing to receive JobKeeper payments will need to:

Advise the ATO of the payment tiers of eligible employees (or your business participant), and

Advise your eligible employees of the payment tier that is applicable to them.

Make sure you keep records of your calculations for the decline in turnover test, and the JobKeeper payment tiers for employees.

Identifying the JobKeeper payment rates

If your business is eligible for JobKeeper from 28 September 2020, you will need to identify all of your eligible employees and the JobKeeper payment rate applicable to them.

From 28 September 2020, the JobKeeper payment rate will reduce and split into a higher and lower rate based on the number of hours the employee worked in a specific 28 day period prior to 1 March 2020 or 1 July 2020.

For eligible employees who have been employed since 1 March 2020, employers need to choose the reference period that provides the best outcome for the employees. For many employers, this will be the pre COVID-19, 1 March 2020 reference date. For eligible employees employed after 1 March 2020, use the pay periods prior to 1 July 2020.

If the pay cycle is longer than 28 days, a pro-rata calculation needs to be completed to determine the average hours worked and on paid leave across an equivalent 28 day period. For example, if the relevant monthly pay cycle has 31 days, you take the total hours for the month and multiply this by 28/31.

Speaking to a MyBusiness podcast, ATO Deputy Commissioner James O’Halloran said the ATO is, “…looking for what is a natural record or support that does demonstrate that effort of active participation in a business on behalf of businesses and in terms of employees on what basis the hours have been done.”

What happens if the employee’s hours were different to normal in the reference period?

Alternative tests are available where:

The reference period is not typical of the employee’s hours or you use a rostering system and there is no typical pattern in a 28 day period - use an earlier 28 day period or multiple 28 day periods that more accurately represent the employee’s typical arrangements. That is, you select the next 28 day period before 1 March 2020 or 1 July 2020 that represents the employee’s typical employment pattern. For workers that don’t have a typical pattern because of a rostering system like fly-in-fly-out workers, an average of the hours worked over the employee’s rostering schedule and proportionally adjusted over 28 days can be used to work out a typical 28-day period.

The employee started work during the reference period. Use a forward-looking alternative test. In these circumstances, use the pay cycle immediately on or after 1 March 2020 or 1 July 2020. For employers with fortnightly or weekly pay cycles, you must use consecutive weeks. Where an employee was stood down, use the first 28 day period starting on the first day of a pay cycle on or after 1 March 2020 or on or after 1 July 2020 in which they were not stood down.

What happens if the employee’s salary is not linked to hours?

Some employees will automatically qualify for the higher JobKeeper payment rate. To qualify for the higher rate, these employees: were paid at least $1,500 in the reference period; were required to work at least 80 hours under an industrial award, enterprise agreement or contract; or, it is reasonable to assume that they worked at least 80 hours during the applicable period.

What about directors and partners in a partnership?

Business participants (sole traders, the self-employed with an ABN, or one partner in a partnership, beneficiary of a trust, or director/shareholder), must use the month of February 2020 (the whole 29 days) as their test period. The test looks at the number of hours you were actively engaged in the business - actively operating the business or undertaking specific tasks in business development and planning, regulatory compliance or similar activities.

Other than sole traders, a business participant must provide a declaration to the business entity confirming their hours worked over the reference period. Sole traders need confirm details with the ATO.

Where February 2020 was not typical, you can use the next typical 29 day period, or if you commenced during February, March 2020.

My employer is no longer eligible for JobKeeper. Can I receive JobKeeper from another employer?

Employees and business participants can normally only have one nominated employer for the JobKeeper scheme (ever). If your nominated employer is no longer eligible for JobKeeper payments, you cannot be a nominated employee of another employer. The main exception to this is where the individual ceased to be employed or actively engaged in the business (as a business participant) of the original entity after 1 March 2020 but before 1 July 2020. They must also have met the conditions to be treated as an eligible employee of the new employer at 1 July 2020.

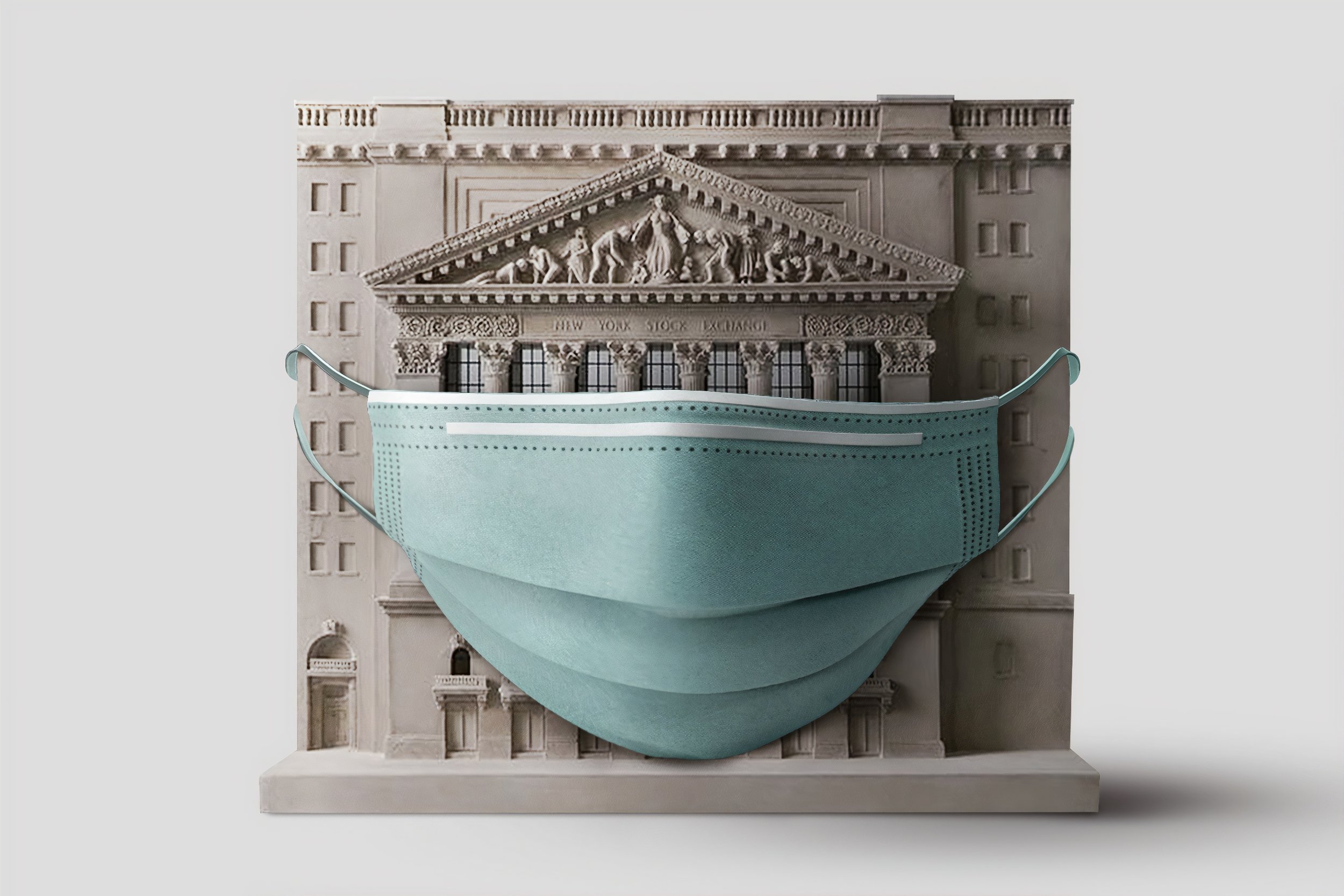

Preventing a tsunami of insolvencies

The Government has stepped in to prevent a wave of insolvencies when the COVID-19 support measures run their course in December 2020.

Temporary insolvency and bankruptcy protections are in place until 31 December 2020 to enable businesses to trade through the pandemic. The measures provide:

A temporary increase in the threshold at which creditors can issue a statutory demand on a company (from $2,000 to $20,000) and the time companies have to respond to statutory demands they receive (21 days to 6 months);

A temporary increase in the threshold for a creditor to initiate bankruptcy proceedings (from $5,000 to $20,000), an increase in the time period for debtors to respond to a bankruptcy notice (21 days to 6 months), and extending the period of protection a debtor receives after making a declaration of intention to present a debtor’s petition;

Temporary relief for directors from any personal liability for trading while insolvent; and

Flexibility in the Corporations Act 2001 to provide targeted relief for companies from provisions of the Act to deal with unforeseen events that arise as a result of the Coronavirus health crisis.

Between March and July 2020, there was a 46% decrease in the number of companies that have gone into external administration compared to the same period in 2019.

Anticipating a wave of insolvencies in early 2021, the Government has moved to streamline insolvency laws to enable small business to either restructure or efficiently wind up. There are three key elements to the reforms:

A new formal debt restructuring process for companies that will enable a business to keep trading under the control of its owners while a debt restructuring plan is developed and voted on by creditors.

A new, simplified liquidation pathway for small businesses to allow faster and lower-cost liquidation.

The measures will be available to businesses with liabilities of less than $1 million. You can find further information on the proposed insolvency reforms here.

In Australia, the insolvency laws currently do not differentiate between large and small businesses. Everyone goes through a similar process. For small business, the complexity and the cost of adhering to the current insolvency system often leaves little for creditors, makes it difficult to restructure, and places control of the business in the hands of an administrator. These reforms should help simplify the process.