Interest Rates Update April 2022

Interest Rates Update 2022

Headline: RBA Cash Rate Remains Steady Despite Rising Concerns

The Reserve Bank of Australia (RBA) has kept the official cash rate at the historically low level of 0.1 percent in their April meeting, despite rising concerns of soaring cost of living for ordinary Australians.

Maintaining its pledge of patience on raising rates amid the COVID-19 pandemic, the Reserve Bank said inflation had increased in Australia, but growth in labour costs had been below rates necessary to lift the cash rate.

The RBA has long maintained that it would require inflation to be sustainably in the two to three percent range before it would consider lifting rates.

However, Australians with mortgages are watching nervously as those on variable rates are likely to see their repayments rise even before the RBA raises the official cash rate.

Australian banks borrow money in offshore markets, which means that as interest rates rise overseas, the bank’s borrowing costs go up and they are likely to pass on the increase.

The war in Ukraine makes the situation more complicated. Financial sanctions on Russia are likely to feed even higher inflation and cause further interruptions to the supply of energy in the form of oil and gas as well as food.

RBA governor Philip Lowe said higher prices for petrol and other commodities would result in a further lift in inflation over coming quarters, with an updated set of forecasts to be published in May.

“The main sources of uncertainty relate to the speed of resolution of the various supply-side issues, developments in global energy markets, and the evolution of overall labour costs," Lowe said.

The RBA is waiting for stronger wages growth to ensure inflation is sustainably in its 2-3% target. How long that takes depends on the reaction time of wage-setting mechanisms and the impact from the reopening of Australia’s international borders last month.

Meanwhile, the big four banks are slashing their variable mortgage rates to win market share ahead of the rate hike expected as soon as June.

However, those low rates only apply to borrowers who can put down a deposit of 30 percent or more as the banks compete for lower-risk borrowers.

The cuts to variable mortgage rates coincide with almost every other week increases in fixed rate mortgage offerings as three- and five-year bond rates continue to soar.

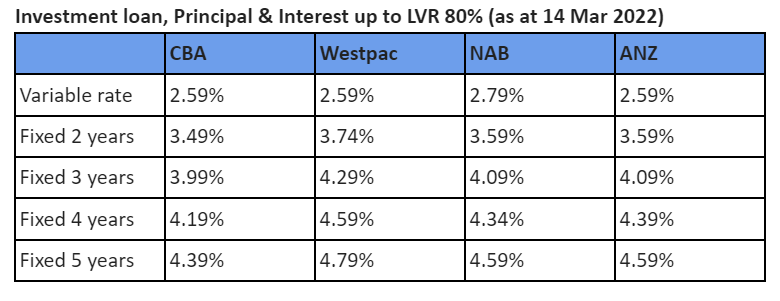

Current Interest Rates (Big 4)

Rates heading higher

The sharp rise in fixed rates in recent months is a result of surging three- and five-year bond rates as global interest rate traders have anticipated that central banks worldwide will begin an aggressive rate-rising cycle to counter higher inflation.

That aggressive outlook partly reflects expectations of a 50-basis-point raise by the US Federal Reserve in both May and June, adding to pressure for other central banks to follow.

The three-year bond rate has surged from 0.3% in late September 2021 to 2.29%, a near eight-fold increase that has forced the banks that match the terms of their fixed-rate loans in the market to increase fixed-rate home loan offerings.

Those higher bond rates imply that eventually variable rates will also rise sharply.

Financial markets have long been priced in a June rate rise to 0.25%, and implied no less than six more hikes to 1.75% by the end of the year. Yields on three-year bonds increased six basis points to 2.46% this week, having already spiked 87 basis points in March, according to Reuters.

This week, ANZ and NAB economists have pushed forward their cash rate rise prediction to June, after the Reserve Bank of Australia left interest rates on hold once again at the record low rate of 0.1%.

Only Westpac is sticking to its forecast of an August rate hike, despite three of the big four anticipating a June cash rate rise. Commonwealth Bank was the first to bring forward its forecast to June, following RBA’s mid-year forecast for trimmed mean inflation.

ANZ now forecasts RBA to tighten by 15 basis points in June, followed up with a 25-basis-point rate hike in July and August, plus a further 25-basis-point increase in November, which will then take the cash rate target to 1% by the end of 2022.

From there, ANZ expects 25-basis-point rate hikes in each quarter of 2023, taking the cash rate to 2% at the end of 2023.

While there are concerns that households will struggle to cope with the sharp increase in interest rates implied by the market, banks and policymakers believe there are sufficient buffers in place.

If you’re looking to take up a new loan or even refinance, act fast before the rates continue going up. Give Darren a call on 0452 339 778 or email him at darren@nineadvisory.com to discuss what options you have available.

Note: The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.