Nine Advisory Small Business Tax Update August 2025

Nine Advisory Small Business Tax Update August 2025

As we move into the 2025/2026 financial year there are some key changes in tax, superannuation and compliance that are set to impact on a range of individuals and business owners. This edition of our newsletter brings together the most relevant updates to help you stay compliant, minimise your tax exposure and make informed financial decisions.

In this issue:

Interest expense deductions: we break down what counts and what doesn’t

Luxury car tax and depreciation traps: the tax rules are more complex than they seem

Superannuation guarantee increases to 12%: ensure your payroll systems and employment contracts are updated to reflect the new rate and avoid costly penalties

Updated superannuation and tax thresholds: key updates to contribution caps, CGT contribution limits, and safe harbour interest rates

Super contributions: get the timing and paperwork right: a reminder on personal super contributions, notices of intent, and total super balance limits

RBA holds interest rates steady: we unpack what the Reserve Bank’s July decision means for your business strategy.

Being across the above updates will enable you to have more control over your cash flow, compliance risk and strategic planning. If you have questions about how these changes affect your business or personal situation, we’re always here to help.

Interest deductions: risks and opportunities

This tax season, we’ve seen a surge in questions about whether interest on a loan can be claimed as a tax deduction. It’s a great question as the way interest expenses are treated can significantly affect your overall tax position. However, the rules aren’t always straightforward. Here’s what you need to know.

The purpose of the loan

The most important thing when looking at the tax treatment of interest expenses is to identify what the borrowed money has been used for. That is, why did you borrow the money?

For interest expenses to be deductible you generally need to show that the borrowed funds have been used for business or other income producing purposes. The security used for the loan isn’t relevant in determining the tax treatment.

Let’s take a very simple scenario where Harry borrows money to buy a new private residence. The loan is secured against an existing rental property. As the borrowed money is used to acquire a private asset the interest won’t be deductible, even though the loan is secured against an income producing asset.

Redraw v offset accounts

While the economic impact of these arrangements might seem somewhat similar, they are treated very differently under the tax system. This is an area to be especially careful with.

If you have an existing loan account arrangement, you’ve paid off some of the loan balance and you then use a redraw facility to access those funds again, this is treated as a new borrowing. We then follow the golden rule to determine the tax treatment. That is, what have the redrawn funds been used for?

An offset account is different because money sitting in an offset account is basically treated much like your personal savings. If you withdraw money from an offset account you aren’t borrowing money, even if this leads to a higher interest charge on a linked loan account. As a result, you need to look back at what the original loan was used for.

Let’s compare two scenarios that might seem similar from an economic perspective:

Example 1: Lara’s redraw facility

Lara borrowed some money five years ago to acquire her main residence. She has made some additional repayments against the loan balance. Lara redraws some of the funds and uses them to acquire some listed shares. Lara now has a mixed purpose loan. Part of the loan balance relates to the main residence and the interest accruing on this portion of the loan isn’t deductible. However, interest accruing on the redrawn amount should typically be deductible where the funds have been used to acquire income producing investments.

Example 2: Peter’s offset account

Peter also borrowed money to acquire a main residence. Rather than making additional repayments against the loan balance, Peter has deposited the funds into an offset account, which reduces the interest accruing on the home loan. Peter subsequently withdraws some of the money from the offset account to acquire listed shares. This increases the amount of interest accruing on the home loan. However, Peter can’t claim any of the interest as a deduction because the loan was used solely to acquire a private residence. Peter simply used his own savings to acquire the shares.

Parking borrowed money in an offset account

We have seen an increase in clients establishing a loan facility with the intention of using the funds for business or investment purposes in the near future. Sometimes clients will withdraw funds from the facility and then leave them sitting in an existing offset account while waiting to acquire an income producing asset. This can cause problems when it comes to claiming interest deductions.

First, even if the offset account is linked to a loan account that has been used for income producing purposes, this won’t normally be sufficient to enable interest expenses incurred on the new loan from being deductible while the funds are sitting in the offset account.

For example, let’s say Duncan has an existing rental property loan which has an offset account attached to it. Duncan takes out a new loan, expecting to use the funds to acquire some shares. While waiting to purchase the shares, he deposits the funds into the offset account, which reduces the interest accruing on the rental property loan. It is unlikely that Duncan will be able to claim a deduction for interest accruing on the new loan because the borrowed funds are not being used to produce income, they are simply being applied to reduce some interest expenses on a different loan.

To make things worse, there is also a risk that parking the funds in an offset account for a period of time might taint the interest on the new loan account into the future, even if money is subsequently withdrawn from the offset account and used to acquire an income producing asset.

For example, even if Duncan subsequently withdraws the funds from the offset account to acquire some listed shares, there is a risk that the ATO won’t allow interest accruing on the second loan from being deductible. The risk would be higher if there were already funds in the offset account when the borrowed funds were deposited into that account or if Duncan had deposited any other funds into the account before the withdrawal was made. This is because we now can’t really trace through and determine the ultimate source of the funds that have been used to acquire the shares.

To do

It’s worth reaching out to us before entering into any new loan arrangements. In this area, mistakes are often difficult to fix after the fact, which can lead to poor tax outcomes. That’s why getting advice from a tax professional before committing to a loan is essential. We can work alongside you and your financial adviser to ensure your loan is structured in a way that makes financial sense and protects your tax position.

Luxury cars: the impact of the modified tax rules

With the purchasing of luxury vehicles on the rise it’s important to be aware of some specific features of the tax system that can impact on the real cost of purchase. Often the tax rules provide taxpayers with a worse tax outcome if the car will be used for business or other income producing purposes compared with a non-luxury car, but this depends on the situation.

Let’s take a look at the key features of the tax system dealing with luxury cars and the practical impact they can have on your tax position.

Depreciation deductions and GST credits

Normally when someone purchases a motor vehicle which will be used in their business or other income producing activities there will be an opportunity to claim depreciation deductions over the effective life of the vehicle. Rather than claiming an immediate deduction for the cost of the vehicle, you will typically be claiming a deduction for the cost of the vehicle gradually over a number of years.

Likewise, a taxpayer who is registered for GST might be able to claim back GST credits on the cost of purchasing a motor vehicle that will be used in their business activities.

However, when you are dealing with a luxury car the tax rules will sometimes limit your ability to claim depreciation deductions and GST credits, impacting on the after-tax cost of acquiring the car.

How does it work?

Each year the ATO publishes a luxury car limit which is $69,674 for the 2025-26 income year. If the total cost of the car exceeds this limit, then this can impact the GST credits or depreciation deductions that can be claimed.

Let’s assume that Alice buys a new car for $88,000 (including GST) in July 2025. To keep things simple, let’s say Alice uses the car solely in her business activities and is registered for GST.

The first issue for Alice is that rather than claiming GST credits of $8,000, her GST credit claim will be limited to $6,334 (ie, 11th x $69,674).

We then subtract the GST credits that can be claimed from the total cost, leaving $81,666. As this still exceeds the luxury car limit, Alice’s depreciation deductions will be capped as well.

While she actually spent $89,000 on the car, she can only claim depreciation deductions based on a deemed cost of $69,674.

The end result is that Alice has missed out on some GST credits and depreciation deductions because she bought a luxury car.

Exceptions to the rules

There are some important exceptions to these rules.

The rules only apply to vehicles which are classified as ‘cars’ under the tax system. That is, the car limit doesn’t apply if the vehicle is designed to carry a load of at least one tonne or it is designed to carry at least 9 passengers.

The rules only apply if the vehicle was designed mainly for carrying passengers. The way we determine this depends on the nature of the vehicle and whether we are dealing with a dual cab ute or not.

For example, let’s assume Steve buys a ute which is designed to carry a load of at least one tonne. This isn’t classified as a car for tax purposes so Steve won’t miss out on GST credits or depreciation deductions.

However, let’s assume Jenny has bought a dual cab ute which is designed to carry a load of less than one tonne and fewer than 9 passengers. This is classified as a car and the luxury car limit will apply unless we can show that it wasn’t designed mainly to carry passengers. As we are dealing with a dual cab ute, we multiply the vehicle’s designed seating capacity (including the driver's) by 68kg. If the total passenger weight determined using this formula doesn’t exceed the remaining 'load' capacity, we should be able to argue that the ute wasn’t designed mainly for the principal purpose of carrying passengers, which means that Jenny should be able to claim depreciation deductions based on the full cost of the vehicle.

The approach would be different if we were dealing with something other than a dual cab ute, such as a four-wheel drive vehicle.

Luxury car lease arrangements

Normally when someone enters into a lease arrangement for a car and they use the car in their business or employment duties there’s an opportunity to claim deductions for the lease payments, adjusted for any private usage.

However, if the value of the car exceeds the luxury car limit then the tax rules apply differently. Basically, what happens is that the taxpayer is deemed to have purchased the car using borrowed money. Rather than claiming a deduction for the actual lease payments, instead we will be claiming deductions for notional interest charges and depreciation, subject to the luxury car limit referred to above.

Luxury car tax

Cars with a luxury car tax (LCT) value which is over the LCT threshold for that year are subject to LCT, which is calculated as 33% of the amount above the LCT threshold.

The LCT thresholds for the 2025-26 income year are:

$91,387 for fuel-efficient vehicles

$80,567 for all other vehicles that fall within the scope of the LCT rules

From 1 July 2025 the definition of a fuel-efficient vehicle has changed, meaning that a car will only qualify for the higher LCT threshold if it has a fuel consumption that does not exceed 3.5 litres per 100km (this was 7 litres per 100km before 1 July 2025).

Buying a car or other motor vehicle can be a complex process and there will be a range of factors to consider. If you need assistance with the tax side of things please let us know before you jump in and sign any agreements

Superannuation rates and thresholds updates

Super guarantee rate now 12%: what it means for employers

From 1 July 2025, the superannuation guarantee (SG) rate officially rose to 12% of ordinary time earnings (OTE). This is the final step in the gradual increase legislated under previous reforms.

What’s changed?

Old rate: 11.5% (up to 30 June 2025)

New rate: 12% (from 1 July 2025)

This increase affects cash flow, payroll accruals and employment contracts, especially where total remuneration includes superannuation.

Employer checklist

Update payroll software: ensure systems are calculating 12% SG correctly from 1 July 2025 pay runs

Review employment agreements: if contracts are set to inclusive of super, the take-home pay of employees may reduce unless renegotiated or the employer decides to bear the cost of the increased SG rate

Budget for higher super contributions: consider possible cash flow impacts

Remember that significant penalties can be imposed for late or incorrect SG payments, including loss of deductions, interest and other administration charges.

Personal superannuation contributions

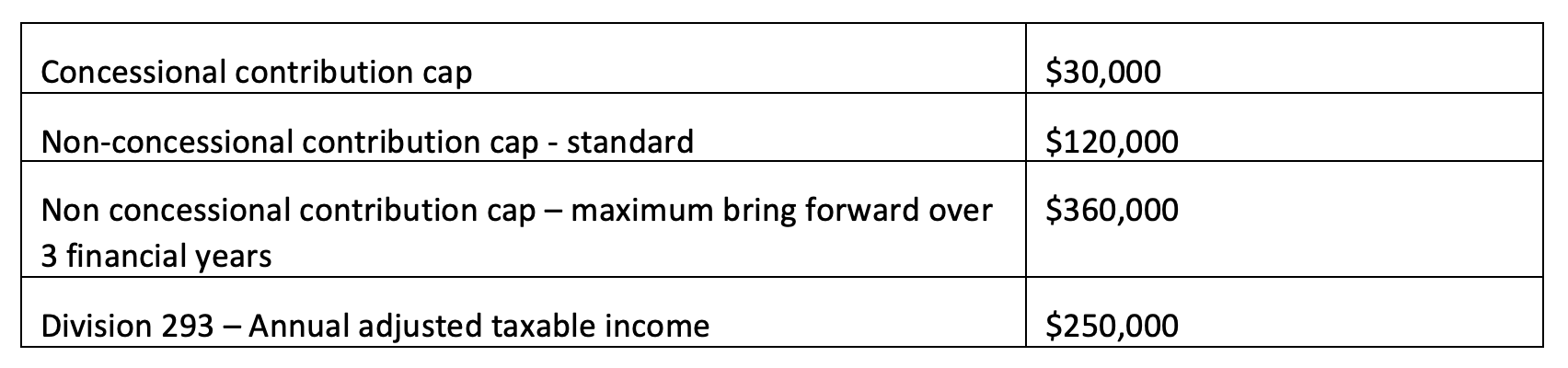

The annual concessional contribution cap will remain at $30,000 for the 2025/2026 financial year. The annual non-concessional contribution (NCC) cap is set at four times the concessional contribution cap meaning it will also remain at $120,000.

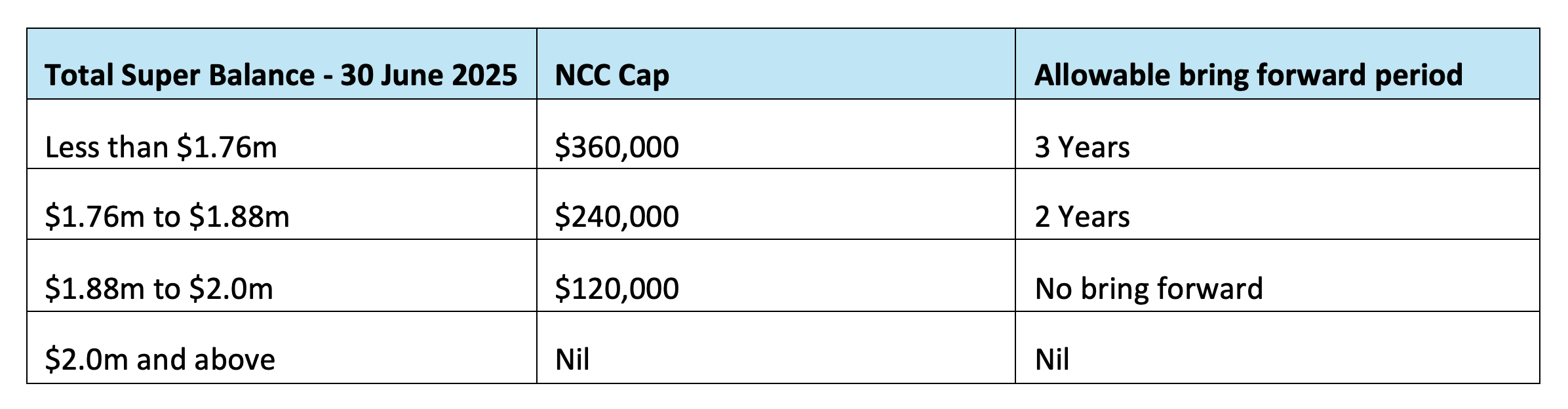

Although the annual NCC cap has not changed, NCCs can now be made by individuals with a total super balance (TSB) of less than $2,000,000 on 30 June 2025 (assuming they have not reached the age 75 deadline and any prior bring forward periods are considered). This is due to the fact that the upper TSB limit links to the general transfer balance cap (TBC) which has increased to $2,000,000.

The relevant TSB amounts for NCCs in the 2025/2026 financial year are summarised in the table below:

Personal deductible contributions

A superannuation fund member may be able to claim a deduction for personal contributions made to their super fund with personal after-tax funds. A member will normally be eligible to claim a deduction if:

The member makes an after-tax contribution to their superannuation fund in the relevant financial year

They are aged under 67 or 67 to 74 and meet a work test or work test exemption

They have provided the superannuation fund with a valid notice of intent to claim

The super fund has provided the member with acknowledgement of the notice of intent to claim

Notice of intent to claim

If the member is eligible and would like to claim a deduction, then they must notify their super fund that they intend to claim a deduction.

The notice must be valid and in the approved form – Notice of Intent to Claim or vary a deduction for personal super contributions (NAT 71121).

The tax legislation provides a notice of intent to claim will be valid if:

The individual is still a member of the fund

The fund still holds the contribution

It does not include all or part of an amount covered by a previous notice

The fund has not started paying a super income stream using any of the contribution

The contributions in the notice of intent have not been released from the fund that the individual has given notice to under the FHSS scheme

The contributions in the notice of intent don't include FHSSS amounts that have been recontributed to the fund.

What you need to consider

The member must provide the notice of intent to claim to the fund by the earlier of:

The day the individual lodges their income tax return for the relevant financial year; or

30 June of the following financial year in which the individual made the contribution.

However, if a super fund member provides a notice of intent after they have rolled over their entire super interest to another fund, withdrawn the entire super interest (paid it out of super as a lump sum), or commenced a pension with any part of the contribution, the notice will not be valid.

This means the individual will not be able to claim a deduction for the personal contributions made before the rollover or withdrawal.

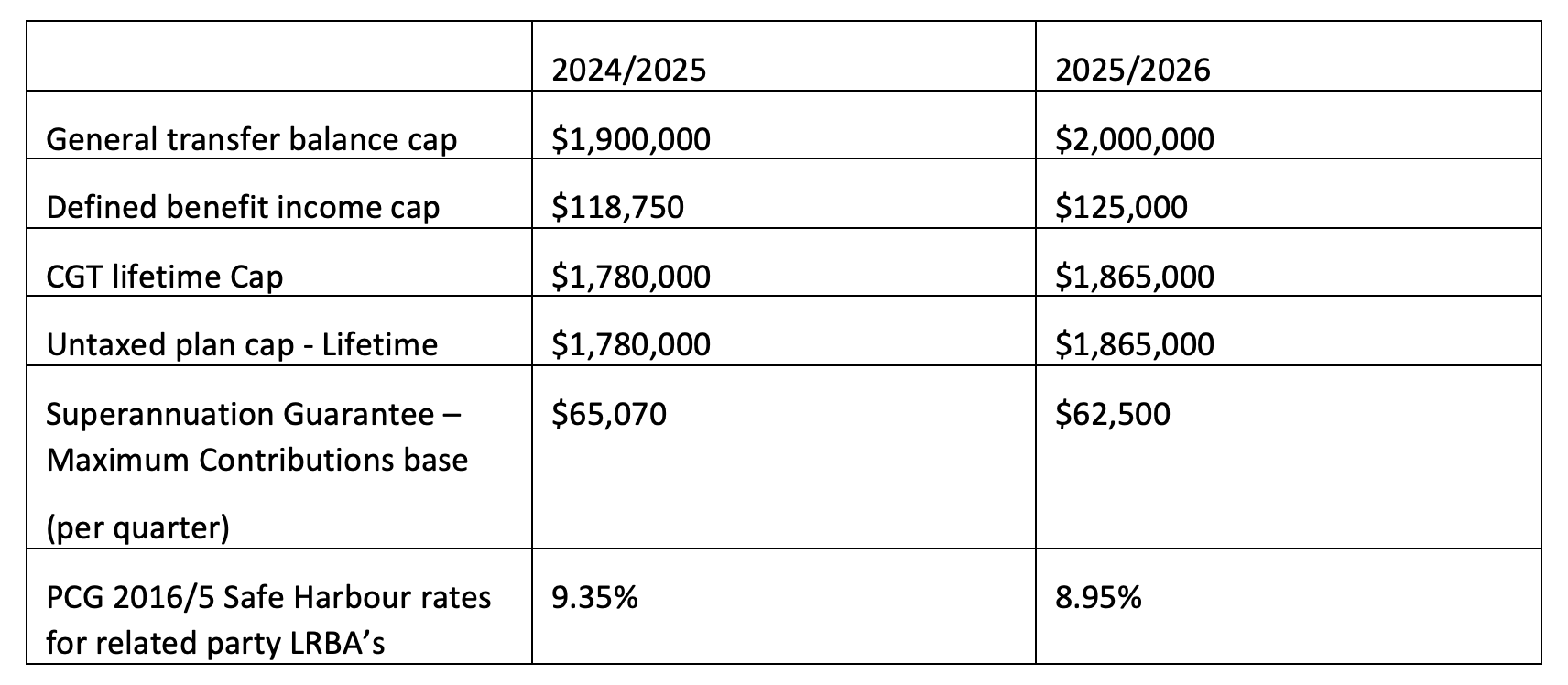

Updated superannuation and tax thresholds: 2025/2026

Remaining Unchanged

The following thresholds will remain unchanged for the 2025/2026 financial year.

RBA Holds Rates at 3.85%: what this means for your business strategy

In a move that surprised many commentators, the Reserve Bank of Australia (RBA) held the cash rate steady at 3.85% in July. A show of caution over action, amid mixed economic signals. Despite headline inflation easing within the RBA’s target band, concerns over economic fragility and employment softness prompted the central bank to delay a widely expected cut.

Why the RBA waited

The Board is awaiting June quarter CPI data to assess whether inflation stability is sustainable

Australia’s labour market is showing early signs of softening, and business confidence has dropped slightly

Consumer spending remains muted, especially among mortgage holding households, which has led some economists to call for a rate reduction to spur activity.

Potential impacts

The interest rate hold means ongoing pressure on loan repayments and cash flow, particularly for those with variable debt or finance leases. Businesses relying on consumer discretionary spending may continue to feel the squeeze. The hold does however give business owners time to prepare. Analysts expect a possible cut in late Q3 or early Q4 if data trends continue potentially providing breathing room ahead of the holiday period. Given where things are at it’s a good time to review your debt exposure, optimise cash flow and consider refinancing options.

There’s a lot to take in. If we can help you with any of the content that’s been covered, please reach out.